Kendall Realty Advisors 30 years of experience (847) 903-7578 Apartment Loans #Apartment Finance Refinance Purchase

Monday, December 17, 2012

FHA Apartment Loan Rates FNMA Apartment Loans 847-903-7578

FHA Apartment Loan Rates FNMA Apartment Loans 847-903-7578

Thursday, December 6, 2012

Interest Rates FHA FNMA Apartment Loans

Thursday, November 29, 2012

APARTMENT LOAN RATES 847 903 7578

Tuesday, October 30, 2012

FHA FNMA APARTMENT LOAN RATES 847 903 7578

Thursday, October 11, 2012

Apartment loan rates FHA A7 223F fast service low fees great rates

Tuesday, October 2, 2012

APARTMENT LOAN RATES CHICAGO NATIONALLY

APARTMENT LOAN RATES CHICAGO NATIONALLYApartment Loans Commercial Mortgages Chicago, Nationally, Small Apartment Loans, FHA 223 F,FNMA DUS, FNMA Small Apartment Loan rates news

Tuesday, July 10, 2012

MISSING Aubrey Lee Price and $17 Million bank deposits - banker owner

Apartment Loans Commercial Mortgages Chicago, Nationally, Small Apartment Loans, FHA 223 F,FNMA DUS, FNMA Small Apartment Loan rates news

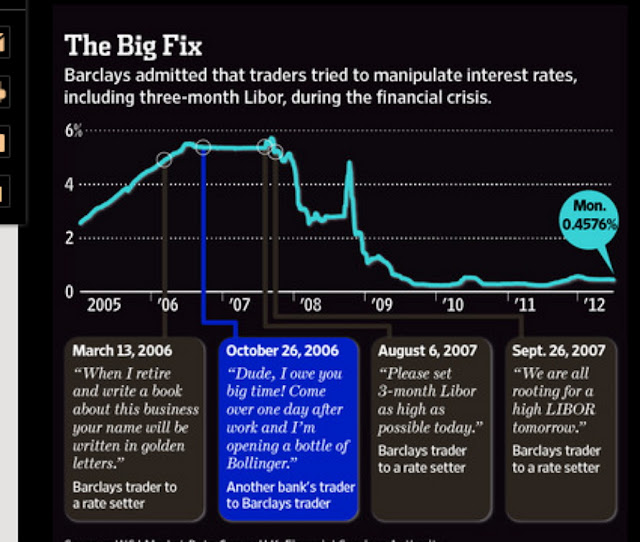

LIBOR MANIPULATING why it matters "A cesspit. Paul Tucker deputy governor of the Bank of England

LIBOR MANIPULATING

Thursday, June 14, 2012

FHA FNMA Apartment Loans 847 903 7578 #APARTMENTLENDER #APARTMENTLOAN

Thursday, June 7, 2012

Small and Large Apartment #Lender #ApartmentLoan Pricing - #ApartmentLender #Apartment #Loan Pricing #FHA223F #FNMA

RATE SHEET LINK

Apartment Loans Commercial Mortgages Chicago, Nationally, Small Apartment Loans, FHA 223 F,FNMA DUS, FNMA Small Apartment Loan rates news

Thursday, May 24, 2012

commercial property, prices recovered to mid-2003 Levels CoStar 2012 News APARTMENT LOAN RATES LINK

APARTMENT LOAN RATES LINK

Despite a generally flat March for pricing of commercial property, prices recovered to mid-2003 levels in the first quarter as improving fundamentals and liquidity causing a broadening of the recovery into non-core commercial real estate and secondary markets, according to this month's CoStar Commercial Repeat Sale Indices (CCRSI) report.

At this rate it will be 2006 in ten short years. Oprah sells her Chicago condo for about 1/2 of what she paid. say $3,000,000 on $6,000,000 cost plus extra shoe closets.

Apartment Loans Commercial Mortgages Chicago, Nationally, Small Apartment Loans, FHA 223 F,FNMA DUS, FNMA Small Apartment Loan rates news

Sunday, February 19, 2012

Jeff Hayward, Senior VP, Fannie Mae Multifamily Division

MHN INTERVIEW: Jeff Hayward, Senior VP, Fannie Mae Multifamily Division

Features, Finance/Investment, Headline News, National, News, Spotlight On Feb 17, 2012 By Jessica Fiur, News Editor

By Jessica Fiur, News EditorWashington, D.C.—Ken Bacon, the current vice president of the Fannie Mae multifamily division, is soon retiring, and it was recently announced that Jeff Hayward, a 25-year Fannie Mae veteran, would be taking over the position as senior vice president. Most recently, Hayward was head of the Fannie Mae National Servicing Organization, where he managed relationships with single-family servicers and oversaw foreclosure prevention efforts.

Hayward recently spoke with MHN about his new role, and what he foresees for multifamily.

MHN: Congratulations on your new role. What are some of the plans you have for the position?

Hayward: I’ve been with the company 25 years, and it is a distinct pleasure and honor to run the multifamily business. We last year helped finance 422,000 units of multifamily housing. My plan right now is to bring as much liquidity to the market as we can bring, keep up all the things that are part of our charter, which is to provide affordability and stability to the market. That’s really our charge, that’s why folks who work for me come to work every day, to make sure you’re fulfilling that mission that you’re supposed to do. I’m excited about that opportunity to do that.

MHN: What do you plan to do differently from your predecessor?

Hayward: My predecessor Ken Bacon did an awesome job before I came, and I’m ever grateful and thankful for what he did. I don’t plan to change much because the things that we were doing hold true, which is, you’re in the market every day making sure that you can finance apartments as they are created or refurbished. That’s not going to change, and you’re there no matter whether or not the market is up or down. That’s a tenant of the business—the steady stream—and we just won’t be changing that.

MHN: Recently there’s been some uncertainty with Fannie Mae. Do you think that’s affecting lenders right now?

Hayward: There are a lot of things that I just flat-out can’t control. And one of the things I can’t control is how others who are not here view us. The only thing we can control is what we deliver to the market, so if we’re there for lenders and we do our part, we can deliver. There’s going to be speculation right now, just because that’s the environment we’re in, but I can’t control it.

MHN: Has the rate of employees leaving Fannie Mae increased because of the uncertainty?

Hayward: I can only specifically talk about the multifamily division, which I run, and it’s been remarkable. People are so energized by the work we do. I haven’t had that problem. I don’t think our turnover rates have been any different than what they’ve been historically. This is a business that finances mostly to people that are at or below median income, so the intrinsic value of serving the market—knowing that’s part of your job, it’s not just profit making—I think that’s a reason why people are inspired and they’re staying in multifamily. I can’t speak for the whole company, but for my division, people have a purpose, and they know it.

MHN: Do you think multifamily will continue to be a steady industry?

Hayward: So the fundamentals of multifamily are, when you’re in a good situation in terms of employment improving, and when the demographics work—meaning people have a job in the 25 to 34 demographic, which is a heavy rental demographic—those people will be out looking for apartments to rent. I think things bode well for the multifamily business. There have not been as many new apartment units started in the last several years, and in the next couple of years there aren’t as many planned to be started, so you’re going to have some of the tension of dynamic supply and demand. There will be more demand, and I think the supply is ample, and that balance should be there over the next couple of years. Whether it’s there or not, I don’t know, but it looks like it’s going to be there.

MHN: Is there anything you’d like to add?

Hayward: Multifamily at Fannie Mae is important, and I can’t emphasize enough, because I get to work with these people, the folks here come to work every day in the multifamily division, the 400+ people, they couldn’t be happier about the jobs they have to do. I didn’t have to come in and do much motivation; folks are just on fire about the mission we have here.

Apartment Loans Commercial Mortgages Chicago, Nationally, Small Apartment Loans, FHA 223 F,FNMA DUS, FNMA Small Apartment Loan rates news

Thursday, February 16, 2012

GlobeSt.com - Agency Finance Is the Driver of the Multifamily Bus - Daily News Article

Wednesday, February 8, 2012

More Than 750 Banks at Risk of Failure over Next Two Years - CoStar Group

Apartment Loans Commercial Mortgages Chicago, Nationally, Small Apartment Loans, FHA 223 F,FNMA DUS, FNMA Small Apartment Loan rates news

Apartment sector upswing lets Amli put third local project on the drawing board - News - Crain's Chicago Business

With big apartment developments already under way in River North and Evanston, Amli Residential is working up plans for its third local one, a two-tower 398-unit project in the South Loop.

Amli CEO Greg Mutz confirms that the Chicago-based developer has signed a contract to buy the 3.5-acre site at the southwest corner of Clark and Polk streets, where it would build the project, just north of a 440-unit apartment building it owns.

“We really want to start this thing this year,” Mr. Mutz says. “We think the South Loop has a lot of upside.”

Amli is buying the property from AvalonBay Communities Inc., which had planned on building as many as 1,000 apartments on the parcel but backed off after the real estate market crashed in 2008.

The good times have returned to the apartment sector, allowing Amli and other landlords to hike rents as their buildings have filled up. And a building boom is well under way, with Amli starting construction last fall on a 409-unit tower in River North and a 214-unit project in north suburban Evanston.

Tuesday, February 7, 2012

Tuesday, January 24, 2012

Monday, January 23, 2012

Equity Residential aced out of Archstone stake - News - Crain's Chicago Business

Lehman Brothers Holdings Inc. closed on the purchase of a $1.325 billion stake in real estate group Archstone, raising its total stake in the sought-after apartment company to 73.5 percent, according to a regulatory filing made public on Monday.

Lehman's purchase sidelined real estate group Equity Residential, which had also sought to buy the 26.5 percent stake in the company from part-owners Bank of America Corp. and Barclays PLC. Lehman had already owned 47 percent of the company.

Read more: http://www.chicagorealestatedaily.com/article/20120123/CRED03/120129940/equity-residential-aced-out-of-archstone-stake#ixzz1kK3w815B

Stay up-to-date on Chicago real estate with our free, daily e-newsletter

Apartment Loans Commercial Mortgages Chicago, Nationally, Small Apartment Loans, FHA 223 F,FNMA DUS, FNMA Small Apartment Loan rates news

Saturday, January 21, 2012

#FHA223F #FNMA DUS and Small Loan Rates Move up with better Job Economic News

FHA 223F and FNMA DUS rates add 3/8% for Small Loans

Treasury Curve ~

Friday, January 13, 2012

Apartment Loan Rates

Apartment Loans Commercial Mortgages Chicago, Nationally, Small Apartment Loans, FHA 223 F,FNMA DUS, FNMA Small Apartment Loan rates news

Wednesday, January 11, 2012

Friday, January 6, 2012

Wednesday, January 4, 2012

#FEDs checking Pay to Play #Section8 contracts #Dupage #Cellini #Ryan #Blago #IL #Business News

Hoicka, the next executive director, said he's fully aware of what he's getting into.

"There have been problems in the past," he said, "but we have a future here, and it's a good future."

Apartment Loans Commercial Mortgages Chicago, Nationally, Small Apartment Loans, FHA 223 F,FNMA DUS, FNMA Small Apartment Loan rates news

Laura Feldman, a spokeswoman for HUD's Chicago office, referred questions to a spokeswoman in Washington, who did not return a message seeking comment.

The latest investigation is far from the agency's first run-in with HUD.

In March, DuPage County Chairman Dan Cronin forced the resignation of the agency's former executive director and all seven of its board members after HUD's inspector general issued an audit, ordering the housing authority to repay $10.75 million in misused tax money.

DuPage was directed to give that money back to its Section 8 housing program because it failed to properly document whether many tenants were eligible to get subsidized rent. It also was cited for making inappropriate credit card purchases, failing to allow competition for projects and, in some cases, overpaying benefits.

HUD officials in Chicago and the DuPage Housing Authority's new board continue to work on resolving the agency's accounting and administrative problems so it can be deemed in compliance by year's end, Feldman said.

"This is an arduous, very complicated, messy situation," she said. "We're still working with DuPage to clean it up."

Tuesday, January 3, 2012

#FHA #HUD Large Apartment Loan Underwriting Parameters #FHA223F #FHA221D4

HUD Issues Large Loan Underwriting Parameters

on Today at 02:32 PM

Due to the current state of capital markets for multifamily finance, HUD has issued new standards for underwriting large multifamily transactions. The intent of the notice is to address the increased risk to the insurance fund presented by loans above $25M or over 150 units. The Housing Notice spells out underwriting standards that will be applicable to such loans in regards to Debt Service Coverage Ratio (DSCR), Loan to Cost Ratio (LTCR), Loan to Value Ratio (LTVR), funding for Initial Operating Deficit (IOD) and Debt Service Reserve (DSR), in addition to other underwriting and credit requirements for such loans.

Highlights:

- Increased DSC test and lower LTVs for new construction or sub rehab loans over $40M and over $50M for refis or purchases (223fs)

- Increases IODs for new construction or sub rehab loans over $25M

- Principal's net worth must be at lease 20% of the loan amount with liquid assets equal to at least 7.5% of the loan amount

- Release of any cash out proceeds for the excess value of the property contributed for a new construction or substantial rehabilitation development must not occur until the completed project has operated at breakeven occupancy for 12 consecutive months.

The new standards contained in this Housing Notice will not apply to:

a) loans below the size/unit thresholds,

b) refinancing loans processed under Section 223(a)(7),

c) refinancing or substantial rehabilitation loans for properties with rental assistance contracts covering 90% or more of the property’s units,

d) the insurance programs administered by the Office of Healthcare Programs (LEAN)

Apartment Loans Commercial Mortgages Chicago, Nationally, Small Apartment Loans, FHA 223 F,FNMA DUS, FNMA Small Apartment Loan rates news