Kendall Realty Advisors 30 years of experience (847) 903-7578 Apartment Loans #Apartment Finance Refinance Purchase

Friday, December 30, 2011

MAC Properties: Gets tax credit tax-exempt bond financing investment

South Loop condo project files Chapter 11 | Residential News | Crain's Chicago Business

A venture controlled by Mr. Mazola that built a 176-unit condominium tower at 1555 S. Wabash Ave. filed for Chapter 11 bankruptcy protection Tuesday. Buyers have closed on just 35 condos in the building, or 20% of the total, with the rest converted to rentals, according to a third-quarter report from Appraisal Research Counselors, a Chicago-based consulting firm.

The Mazola venture lists both assets and liabilities of $10 million to $50 million, according to its Chapter 11 petition.

The document doesn't break out the project's secured debt, but its biggest liability likely is the construction loan it took out to finance the 14-story development. The venture borrowed $46.2 million from Amtrust Bank in 2007, county records show. No foreclosure suit has been filed.

Mr. Mazola, president of Chicago-based New West Realty Group LLC, says the filing is “just a partnership filing and it is what it is.” He declines to comment further. His lawyers also decline to comment.

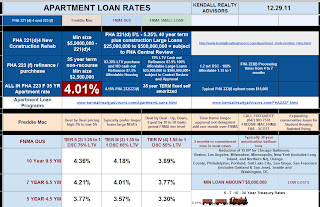

#Apartment #lender #Loan Pricing #IL #Chicago #Nationally #FHA223F #FNMA

FNMA Small Loans FHA FNMA FREDDIE MAC LARGE LOANS

Apartment Loan Pricing 12-30-11

Thursday, December 29, 2011

Apartment Loan Rates decline Treasury Rally yesterday to a four aces on EU Bank fears

Apartment Loan Rates Indicated by treasuries

Wednesday, December 28, 2011

Class of 2007 Loans graduate to #ROLLOVERS #DELINQUENTCY Overleverage

OVER LEVERAGED FINANCING FRENZY LOANS STARTING TO MATURE in TIGHT CREDIT MARKETS APARTMENTS CLASS HAS HIGHEST PROSPECTS FOR SUCCESS

Prospects Dim for Take-Out Financing on 2012 Loan Maturities

Over the next 12 months, CoStar is expecting $100 billion in loans Of that amount, $70 billion is coming due for the first time, and another $30 billion in loans is delinquent but rolling on a monthly basis past their maturity date.

2012 will also usher in the first major wave of maturities from the 2007 vintage, which were issued during a frothy period at the peak of the market."

However, prospects appear dimmer for borrowers trying to find take-out financing for these loans in 2012,

according to bond rating agencies

"The retrenchment in the capital markets and among other lenders in the third quarter of 2011, which has

continued into the current quarter, dims the refinancing prospects for loans maturing next year," Kay said.

Kay estimates that 50% to 60% of the 2007 vintage five-year-term loans maturing next year may fail to refinance, and retail loans are at the greatest risk.

Moody's also said that the balloon refinancing risk is material for 2006-2008 vintage loans.

Stocks sell off as EU BANKS refuse to trust each other

terminated lending to each other. Typically without government support bank runs will follow.

U.S. Banks are some what reloaded from free treasury profits and they where told not to hold much EU crap.

We also need to watch IRAN NEWS new sanctions really messed them up 30% currency decline hoarding gold and dollars they might really try to shut down the straight and we know what the governmentmiltarycorporation would do then bomb bomb bomb

and GAS GOES UP UP UP

The European Central Bank said the continent's banks parked a record $590.7 billion with it overnight, suggesting that those banks are less willing to take the risk of making short-term loans to each other, opting instead to earn low interest rates from the ECB. The disclosure also hurt the euro, which fell more than 1% against the dollar, to $1.29.

What will the #end of #FNMA and #FreddieMac for the Single Family SINS Mean for Apartment Loans

No MATTER WHAT SINGLE FAMILY LOAN RATES WILL RISE LOCK IN IF YOU CAN NOW.

It is only delayed - (their corporate sins as viewed by congress people are too high to keep them ) THE Collective SINS of these Companies and former Executives doomed them for Eternity and now the choices are which HIGHER PRICED LOAN PROGRAM will the United States move to post Agency Execution.

The APARTMENT LOAN DIVISIONS ARE BOTH PROFITABLE AND have supper low defaults and losses. They must be spun off or something to get them out of the agencies under Congress's executioners orders.

There are currently several models.

1. Private Everything let banks and finance companies make the loans with no insurance wrap like now from the federal government.

This will lead to spotty lending in middle and lower class neighborhoods and rates will go up at least 1.5% over current spreads over ten year treasury. This is favored by GOP private everythingers..

2. Some sort of covered bonds scheme. I don't get covered bonds for some reason. Maybe a little government insurance.

3. Since they are making a profit have low losses and basically where one of many parts of the agencies that worked swell make them into new companies, add competition with good capital and give them a GNMA like government insurance wrap if they meet all the net worth, servicing and honesty tests. This is backed by most intelligent people in the apartment mortgage business which is not quite as sleazy as the single family side.

More later

Sunday, December 25, 2011

FHA 223(f) APARTMENT LOANS FNMA DUS - Freddie Mac FNMA Small Apartment Refinance - Purchase Chicago IL National Commercial Mortgages - Large Apartment Loans

FNMA Small Apartment Refinance - Purchase Chicago IL

National Commercial Mortgages - Large Apartment Loans

APARTMENT LENDER COMMERCIAL MORTGAGES CHICAGO: FHA 223(f) Multifamily Loan Agency Loan Rates Apri...

FInally

Scott Kendall (847) 903-7578

Your Apartment Lender

Now offering Remolding Services Siding Windows Doors interior exterior improvements repair

Out partner Siding1 Window1 over 25 years of quality service call Scott to set up an inspection and quote.